TEO

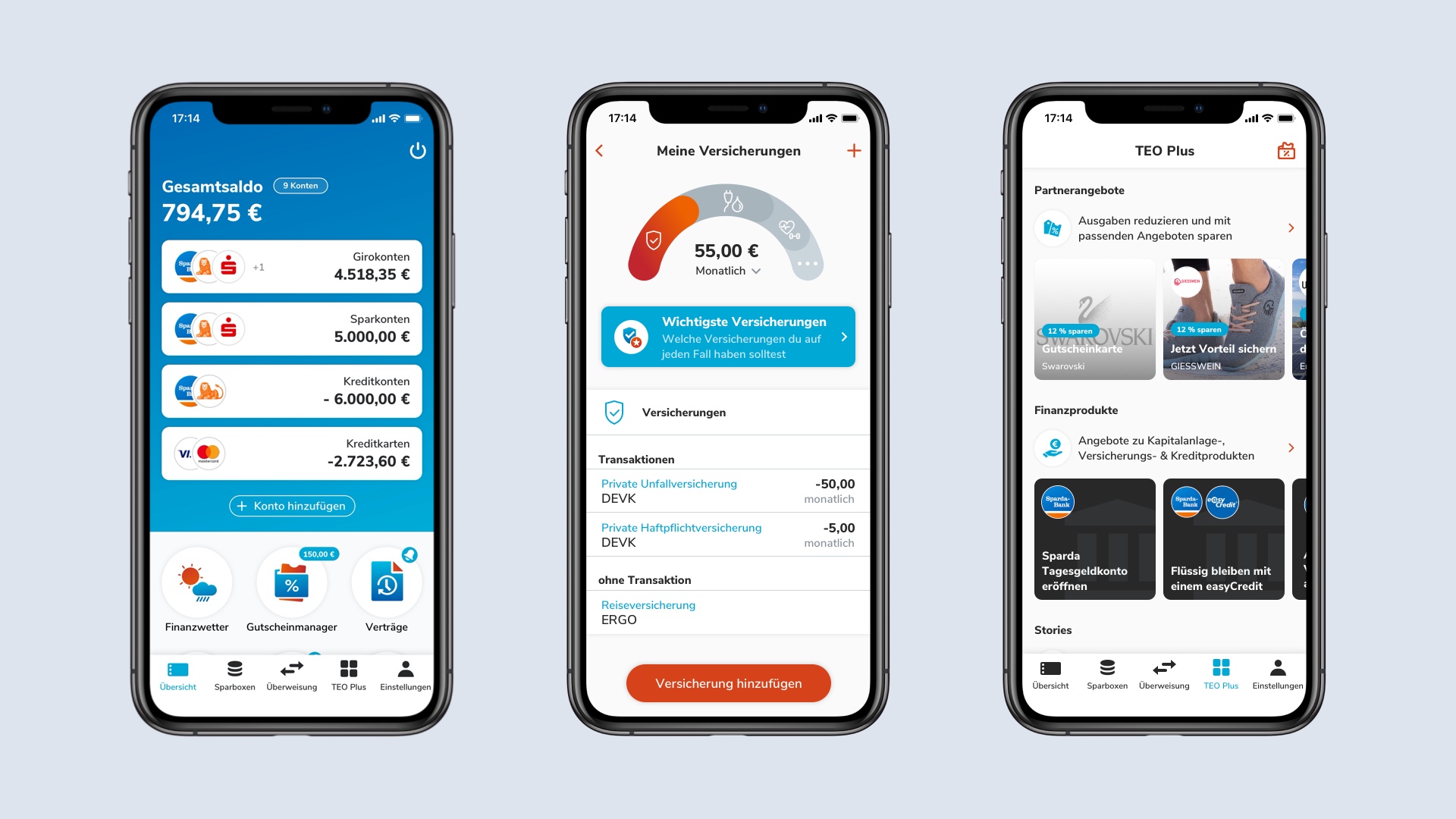

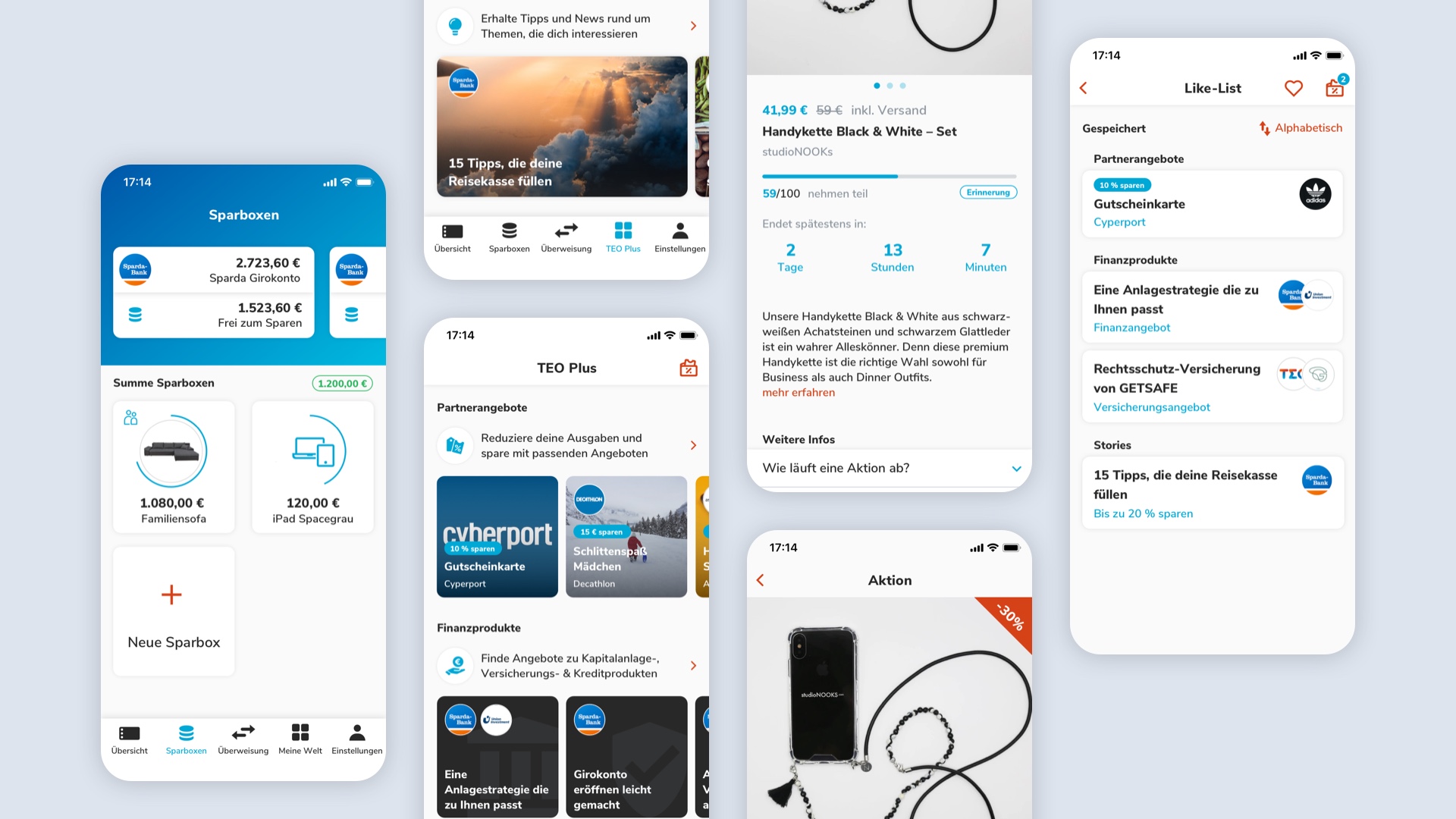

TEO is a multibanking app designed primarily for Sparda banks, offering users a seamless banking experience with added value beyond traditional financial services. By integrating an ecosystem of features, TEO enhances customer engagement and convenience.

The app is available in all app stores and free for download

Project Lead & UX Design

Project Overview

As Project Lead and UX Designer within the Innovation Hub, I was responsible for successfully integrating insurance services into the multibanking app TEO. The project aimed to convert existing Sparda Bank customers into insurance clients while also acquiring new customers for Süddeutsche Versicherung (SDK) and Sparda Versicherungen.

The challenge was to seamlessly combine banking and insurance into a single user experience, overcome technical constraints across different platforms, and create a user-centered business model for both banks and insurers.

Problem Statement & Objectives

Many banking customers lack an overview of their existing insurance policies and potential coverage gaps. The project goals were to:

UX & Product Strategy

To ensure an optimal user experience, I developed a comprehensive UX process, including:

User Research

Analyzing user behavior and conducting interviews to identify pain points

Prototyping & Testing

Creating interactive prototypes for web & mobile

Iteration

Refining the customer journey based on usability testing insights

We leveraged established UX patterns from the insurance and banking industries to create an intuitive navigation and frictionless policy purchase experience.

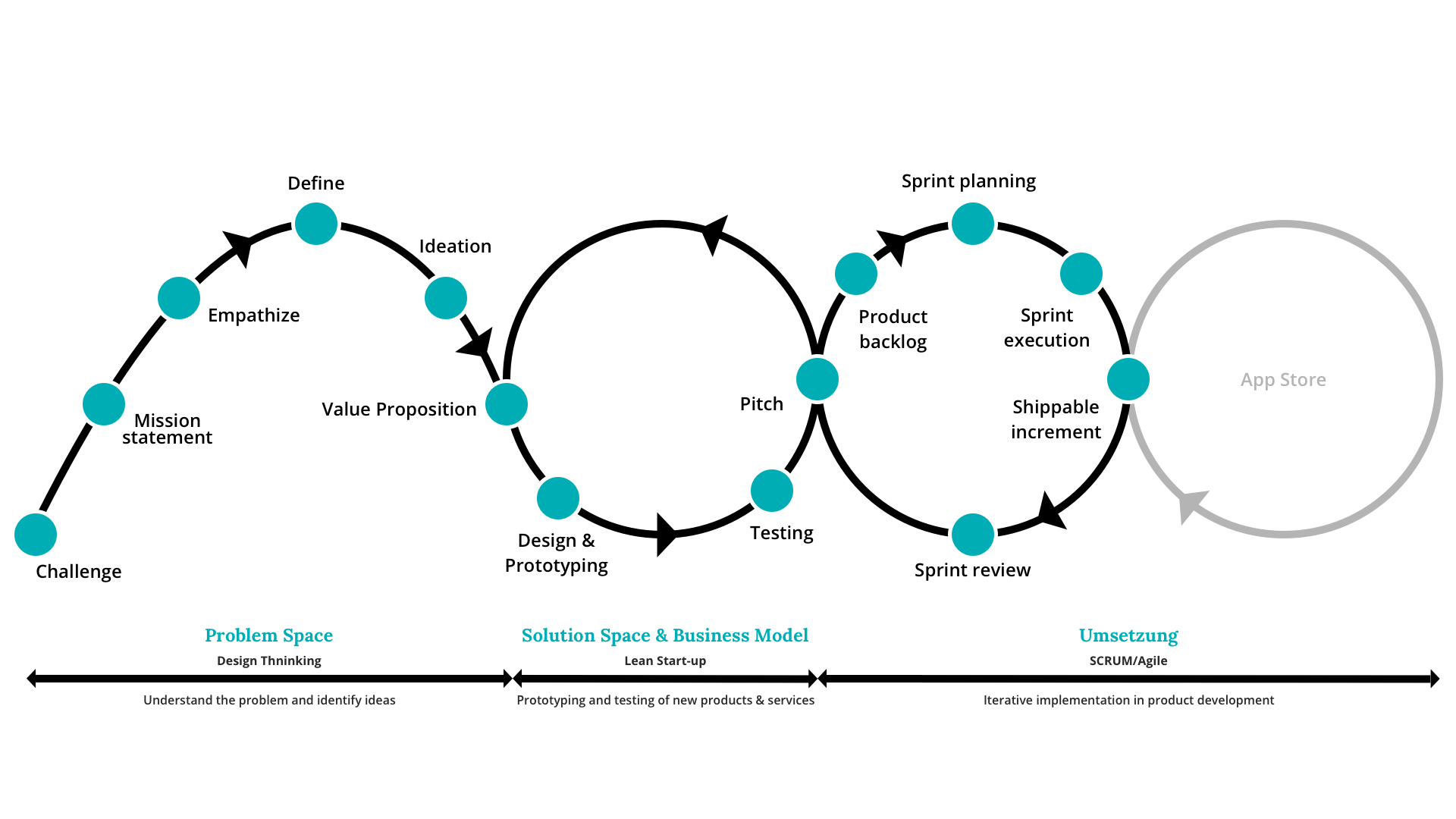

Innovation Process & Continuous Improvement

The banking industry is evolving rapidly, requiring companies to adapt dynamically to deliver greater customer value. At TEO, we take a user-centric innovation approach, continuously monitoring emerging technologies, industry trends, and the competitive landscape to stay ahead.

By conducting customer interviews and usability testing, we gather direct user feedback to drive the iterative development of new features. This ensures that TEO remains a dynamic, user-driven product, evolving to meet the changing needs of its users.

Solution & Implementation

Data-Driven Recommendations

An algorithm analyzed financial flows and peer comparisons to suggest relevant insurance policies.

Personalized Offers

Users received better rates through data-driven insights.

Seamless Integration

Insurance policies could be purchased directly via the app or discussed with a personal advisor.

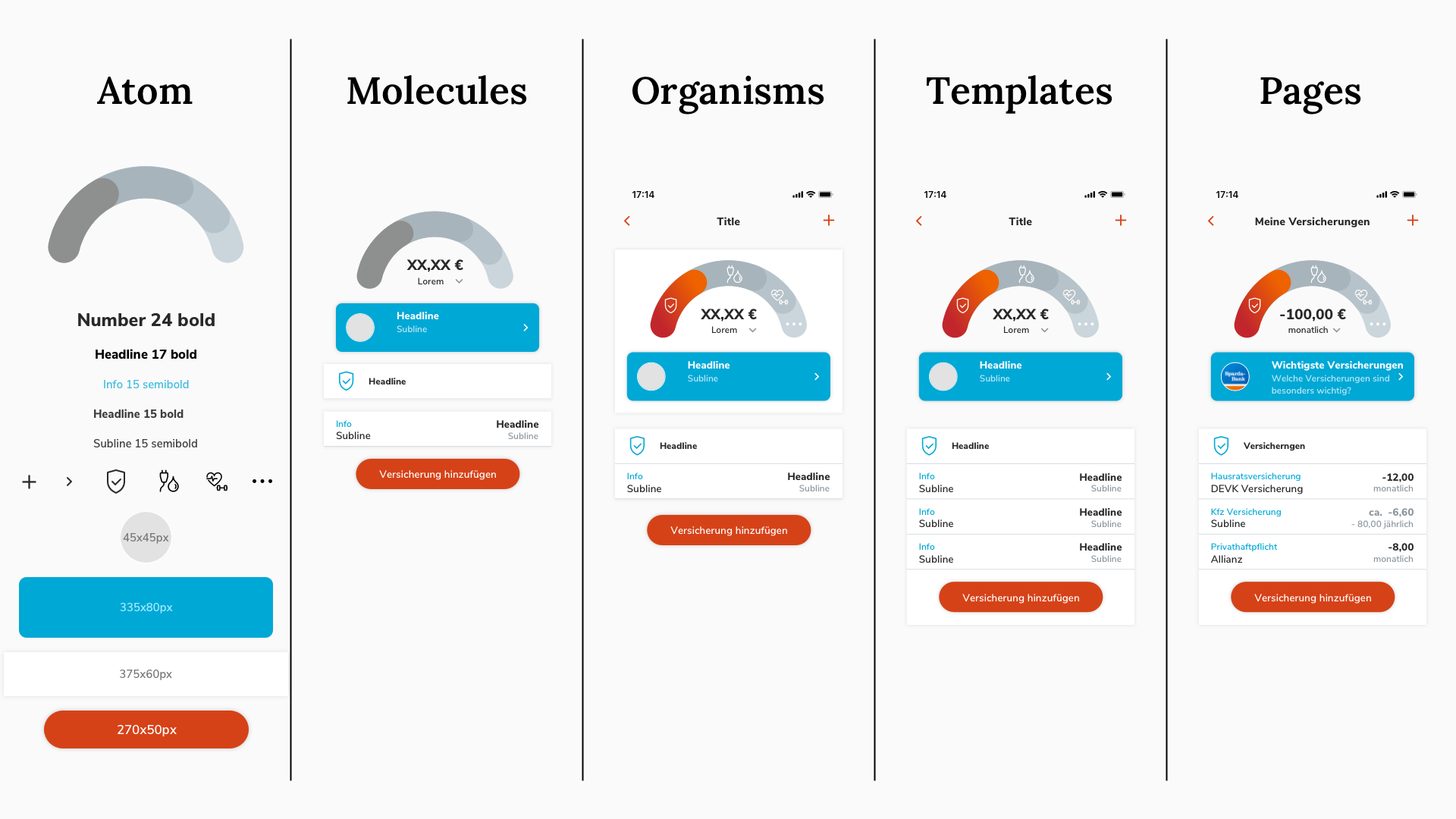

Design System for Consistency

A modular design system ensured visual and functional consistency across web and mobile platforms, improving usability and speeding up development.

Technical Challenges & Solutions

- Different programming languages for web, app, and insurance platforms were solved by a middleware integration through an external service provider.

- The integration used Single Sign-On (SSO), allowing users to manage all their finances in one place.

Design System using the example of an Insurance Manager

Results & Success Metrics

The project was considered a success from a business perspective.

Key KPIs:

Learnings & Key Takeaways

Managing Stakeholders & Cross-Industry Collaboration

Aligning banks, insurers, and an external partner required strong stakeholder management and clear communication to balance business goals and user needs.

Seamless UX in Regulated Industries

Compliance and trust-building UI were key to ensuring a low-friction onboarding while integrating insurance into banking.

Data-Driven Personalization

Leveraging financial data analytics and user behavior insights improved the relevance of insurance recommendations and boosted engagement and conversions.

Omnichannel UX & Technical Constraints

Bridging legacy insurance systems with modern banking APIs required a middleware solution to ensure a consistent cross-platform experience.

Scaling with a Design System

A component-based design system streamlined UI development, ensuring a cohesive experience across mobile and web while maintaining brand consistency and accessibility.

Reducing Friction to Increase Conversion

Lowering entry barriers through contextual in-app prompts and simplifying decision-making with progressive disclosure and trust-building UI patterns improved conversion rates.

Business Impact Through UX

A customer-first approach increased customer acquisition, cross-selling revenue, and retention, proving the business value of UX.

Other Key Initiatives

Facilitated multiple Design Thinking workshops to align stakeholders and define user-centric solutions.

Worked closely with Marketing to develop landing pages and email campaigns for A/B testing and performance optimization.

Credits

COMECO GmbH & Co. KG

Contact

Kevin Bareiss

Stuttgart, Germany

Email: hello@kevinbareiss.com

LinkedIn: Kevin Bareiss

© Kevin Bareiss 2021